Diversity VC Digest ☕🤑

Your (monthly) digest of all things DEI in venture capital. February edition.

WOAH it’s still only February?! Buckle up for the latest on the woke, the zombies and the bogeymen of venture…just another February (sometimes bonkers, never boring) in DEI venture happenings. Plus, an update on our New Year’s commitments - 🤩 HELLO INTERNATIONAL PALS 🤩 - and of course, the latest funding news, funds to watch, upcoming events and conferences, and the headlines making the case for diversity in VC…

‘If January is the month of change, February is the month of lasting change. January is for dreamers. February is for doers’…(apparently)

Welcome to the February edition of the Diversity VC newsletter. And do we have A LOT to update you on. 🥳 We formally welcomed our LatAm Chapter to the Diversity VC global community 🥳 We celebrated the launch of the State of Dutch Tech report (more news coming from our Dutch adventures soon 🧡), and we were blown away by the founders presenting at the demo day (and rebrand!) of the Inclusive Ventures Lab at Morgan Stanley.

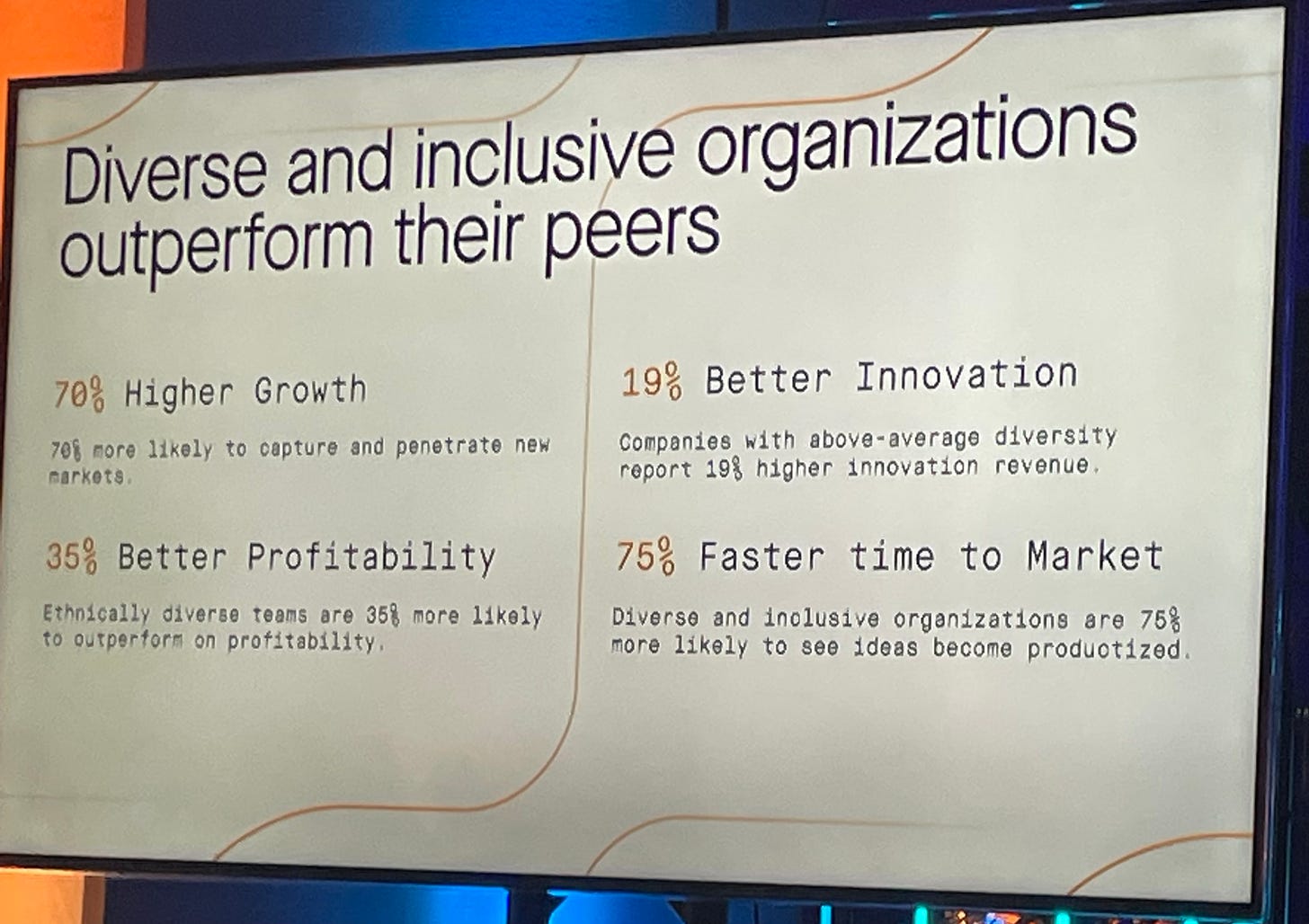

Diverse and inclusive organisations outperform their peers

With all of this positive momentum the shock story came from news of the Tech Nation ‘shut down’, forcing the newly appointed Barclays Eagle Labs to publish a rebuttal and clarify that “We’re not the ‘bogeyman’ - we’re ready to support UK tech” ☠️

😱 Buckle up: ‘woke investing’ is about to get political, as Ohio biotech entrepreneur Vivek Ramaswamy, “who’s railed against ‘woke’ investing based on environmental, social and governance principles,” has officially launched his bid for the Republican presidential nomination in 2024.

The political cosplay storylines we didn’t see coming don't stop there, with Vanguard CEO Tim Buckley playing defence after the company dropped out of the Net Zero Asset Managers initiative, telling the FT that the $7.2 trillion asset management firm’s voice was being “drowned out or confused. It would be hubris to presume that we know the right strategy for the thousands of companies that Vanguard invests with. We just want to make sure that risks are being appropriately disclosed and that every company is playing by the rules,” he said.

Could these US headlines translate across jurisdictions and venture-friendly regional playgrounds? It is only two months into the year after all…and venture is a beat even the high fashion publications are interested in…case in point this excellent Harpers Bazaar profile - highlighting that DEI is more than a nice to have, but is instead an imperative, otherwise we are hindering innovation - we pulled out some particularly powerful quotes below:

Silicon Valley likes to celebrate and lionize disruptors. But for women in the tech industry who speak out, there can be a high price to pay for rocking the boat. An incredible profile piece from Harpers Bazaar. “Haugen likens what she saw among colleagues at Facebook to a kind of “moral injury,” a term coined by psychiatrist Jonathan Shay to characterise the “undoing of character” experienced by Vietnam War veterans. “I would see people with a sense of learned helplessness, like nothing could be done,” says scientist and AI ethicist Timnit Gebru. “It actually hinders innovation.”

“It constantly puts people on the defensive, to clean up the harms—rather than giving people from different backgrounds the ability to innovate and forge our imagination of the future”

And because we couldn’t not include some FTX intrigue updates: Venture capital and private equity firms including Sequoia Capital, Thoma Bravo and Paradigm are being accused in a lawsuit of hyping the legitimacy of FTX, the collapsed cryptocurrency exchange, reports Bloomberg.

Policy watch 👀

In case you missed it: our friends at i3 Investing guest blogged for the launch of LGBTQIA+ History Month, we spoke to both the UK and Dutch governments about the case for DEI in venture capital, and the LatAm Chapter launch has already sparked the data debate to kickstart venture at scale on the continent. Lots more coming in this space, an opportune and exciting time to be flying the flag for DEI unlocking a tremendous economic opportunity for those who have understood its inherent compatibility with the venture returns model.

Who's to blame for venture capital's bloat? Last month we linked to the SEC’s consultation that would - ostensibly - make it easier for LP’s to sue GP’s who they claim have mishandled their investments, and this month we hear the rebuttal. More here.

And in more regulator news, this time from the FTC…are other regulators paying attention to the antitrust strategy emerging from the US? Antitrust is arguably the topic to watch for venture investors as model venture investments rely on scaling to achieve their returns multiples, and antitrust is one, if not the, biggest risk factor for most technology startups when mapping out their growth strategy.

Diversity in venture news

Proud Ventures report Three quarters of LGBTQ+ founders hide their identity from investors.

12.9%. That’s the percentage of female general partners at the 85 VC funds backed by German LP KfW, one of Europe’s biggest VC backers. More from Sifted here.

Change Ventures Baltic Startup Funding Report is a semi-annual publication of detailed data about funding rounds for startups in the Baltics, including companies with HQs elsewhere but with a dominant base in Estonia, Latvia or Lithuania.

Running with this European news theme, a hot-off-the-press piece Inside the machine powering French tech’s rise. A long read on Bpifrance.

Investor appetite, microfunds help seed investing defy startup drubbing.

The Rose Review has published its third year progress report into Female Entrepreneurship, reporting women starting a record number of new companies.

The launch of the Inclusive Ventures Lab at Morgan Stanley. An accelerator designed specifically for women and ethnic minority founders, where they can find valuable expertise, connections and finance. Applications for their next cohort are now open.

Know Founders in London, UK? The OneTech LIFT Funding Readiness Programme is an initiative funded by the boroughs of Camden, Hackney, Islington and Tower Hamlets, delivered by Capital Enterprise. Apply here

The economic outlook is uncertain. Contingency plans are in place. But business investment in technology outside of Silicon Valley remains remarkably resilient.

😲 Rise of ‘zombie’ VCs haunts tech investor as plunging valuations hammer the industry. Maelle Gavet, the CEO of Techstars, predicts that the portion of zombie VCs in the US might even reach 50% in the next three years. The European VC ecosystem might get less affected, due to its strong ties to government LP capital. So watch out: can’t see any deals done? No new hires? You might have come across a zombie fund! Read more here.

In future of tech and ethical responsibility news, TikToks are coming back to haunt their teenage creators. “I was just talking about how I feel. It’s supposed to be a good thing to do that,'' 19-year-old Aly Drake, who has 4,000 TikTok followers, tells the Washington Post. “It was pretty shocking to see the consequences of the way you post.”

Five reasons why emerging and diverse fund managers outperform. Find out more and follow Impact Shakers

Check out a handy guide to Income Share Agreements from our friends at Horizan VC.

Can ‘we the people’ keep AI in check? Technologist and researcher Aviv Ovadya isn’t sure that generative AI can be governed, but he thinks the most plausible means of keeping it in check might just be entrusting those who will be impacted by AI to collectively decide on the ways to curb it. More here.

Funds and funding news

Tallinn-based accelerator and early-stage investor Startup Wise Guys (SWG) has closed the first €25m of a targeted €45m fund to strengthen the firm’s new strategy of investing in “overlooked” global markets — from southern Europe to Africa. More from Sifted here.

Net Zero funding suppliers - an updated list published by the small99 platform in the UK.

Thatch, a five-year-old San Francisco startup that aims to simplify health benefits for startups and their employees, raised a $5.6 million seed round co-led by Andreessen Horowitz and GV, with additional participation from Lux Capital, Quiet Capital, Not Boring Capital, and BrightEdge. TechCrunch has more here

CVC’s take part in more than a fifth of European VC deals. Corporate venture capitalists may have invested less last year, but they still took part in more than a fifth of all European VC rounds. CVCs participated in 2,375 European rounds in 2022, worth an aggregate €42.6 billion (about $46.3 billion). More from Pitchbook here.

Highland Europe closes a milestone $1bn VC mega-fund to support high-growth European internet, mobile, and software companies with over €10m in annualised revenues, and joins DTCF and EQT Ventures that recently also announced €1bn+ funds.

Dutch agtech Source.ag secures $10m for its indoor farms.

Kita, a London-based insurtech focused on reducing the risks associated with carbon purchases, has secured a £4m funding round. “To prevent the worst impacts of climate change, we must remove gigatons of CO2 from the atmosphere annually for the remainder of the 21st century,” said Natalia Dorfman, co-founder and CEO of Kita. More here.

The European Tech Champions Initiative launches a new €3.75bn Fund of Funds to deepen Europe’s scale-up venture capital markets and bridge a funding gap for scale-ups wanting to raise €50m, consequently, aiming to improve the chances of success of the European startups on the global scale. Read more here.

Goldman Sachs Global Head of Sustainability Dina Powell McCormickis now the board chair of Robin Hood, a New York-based anti-poverty organization. Policylink Founder-in-Residence Angela Glover, Blackstone CFO and Senior Director Michael Chaeand Reddit co-founder and former Executive Chairman Alexis Ohanian have also joined the board. More (US) people moves here. Drop us a tip for global movers and shakers.

Future VC

A New Year might mean a potential new job for those in your networks looking for junior, including associate and intern, roles at VC Funds - be a guardian angel and share this link: Future VC Jobs Board

Want to post a role? Get in touch here.

Mark your calendars…

We are thrilled to be welcoming so many of you to our sold out International Women’s Day (IWD) event in proud partnership with Women In Venture Capital: Europe - excited to see so many of you there on 8 March 🎉

🗓️ Mark your calendars for upcoming venture friendly conferences - let us know if you are attending, we’d love to hear the main insights and takeaways from our community

SXSW - March 10-19

Catalyst Cap Intro: Alternative Investing Funds 2023 - Mar 20

RISE, HK - March 21-23

💛 A look ahead to the diversity and inclusion dates in the coming weeks:

Zero Discrimination Day - March 1

International Women’s Day - March 8

Neurodiversity Celebration Week - March 13 - 17

International Day of Happiness - March 20

International Day for the Elimination of Racial Discrimination - March 21

Ramadan (Muslim) - March 23

Trans Day of Visibility - March 31

Got tips?

Have a tip? Want to be featured for some excellent diversity, equity and inclusion work your Fund wants to shout about? Email us your stories

Added value…

You can add the Diversity VC 2023 calendar for a list of the conferences and diversity & inclusion days for the year ahead: here